The Group engages in a wide variety of finance-related businesses with the provision of innovative, highly convenient financial products and services via the Internet.

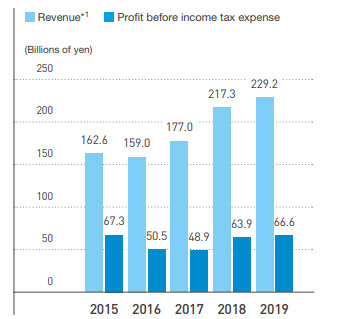

Financial Services Business *2

*1 Beginning with the fiscal year ended March 31, 2016, the income categories “Operating revenue” and “Other financial income” have been eliminated, and the amounts have been combined and presented as “Revenue.” Figures for the year ended March 31, 2015 are “Operating revenue.”

*2 For the fiscal years ended March 31, 2015 to 2018, whereas there are Group companies that were transferred from one segment to another, the above mentioned figures reflect disclosed figures for each fiscal year, so there may be some discrepancies.

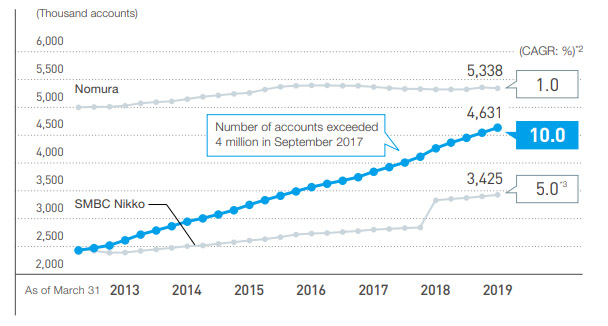

Number of Accounts of SBI SECURITIES and

Two Major Face-to-face Securities Companies *1

Sources: Each company’s published information

*1 As of March 31, 2017, Daiwa Securities’ number of accounts totaled 3,886 thousand accounts.

Daiwa Securities has not disclosed its figures beyond March 31, 2017

*2 June 2012 to March 2019

*3 Merged with SMBC Friend Securities in January 2018

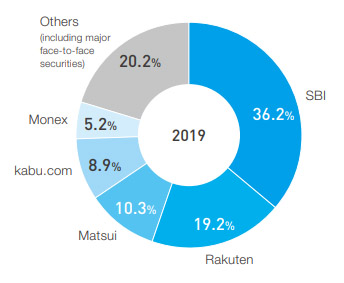

Shares of Individual Stock Trading Value in Japan

Note: Shares are calculated by dividing each company’s individual stock trading value with the whole individual stock trading value of the 1st and 2nd section of the Tokyo and Nagoya Stock Exchange, including that of ETF and REIT trading value, respectively Sources: Tokyo Stock Exchange statistics; each company’s published information

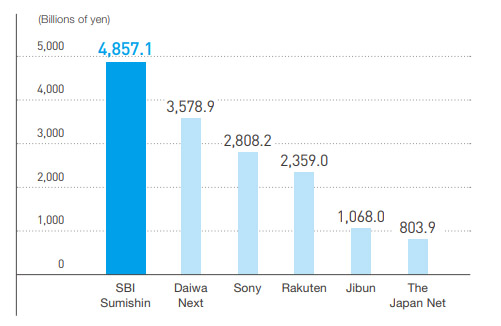

Deposit Assets at Six Pure-play Internet Banks

(Non-consolidated)

Sources: Each company’s published information

Note: As of March 31, 2019