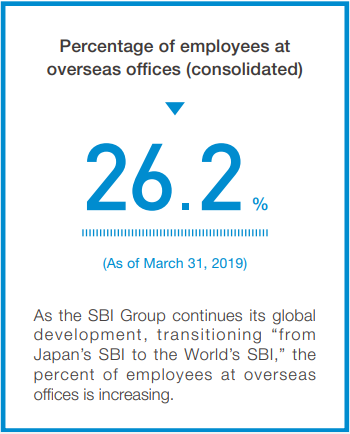

Established in 1999, the SBI Group has formed the world’s first and leading Internet-based financial conglomerate, providing financial services in a broad range of fields including securities, banking and insurance. In addition to Financial Service Business, the Group also has Asset Management Business (managing Private Equity AUM in excess of USD 4 billion) focusing primarily on investment in venture companies and Biotechnology-related Business embarking on global expansion from R&D and product development to sales in the pharmaceuticals, health foods and cosmetic products. As a Strategic Business Innovator, the SBI Group takes on the challenge of realizing sustainable growth, placing these business segments as its three core businesses.

Being one of the largest Japanese private equity firms with AUM in excess of USD 4 billion, the SBI Group has invested in more than 1,500 companies globally, and we leverage this broad platform to further drive the value of our investments.

As of March 31, 2019, the SBI Group consists of 226 companies (including consolidated partnerships, equity method affiliates and 6 publicly listed companies). SBI currently has overseas offices in more than 21 countries across Asia.